SE CASC Project Highlights Connections between Climate Change and Rising Flood Risks

SE CASC researcher and 2015-2016 Global Change Fellow Georgina Sanchez was recently quoted in an article based on findings from the SE CASC project, Improving Scenarios of Future Patterns of Urbanization, Climate Adaptation, and Landscape Change in the Southeast. The following post published by NC State’s College of Natural Resources, was written by Andrew Moore and can be viewed here.

Many Americans Lack Flood Insurance Despite Rising Risks — Here’s Why

As climate change and urbanization increase the risk of flooding across the United States, millions of Americans remain unprotected against damages. NC State researchers are working to solve that problem.

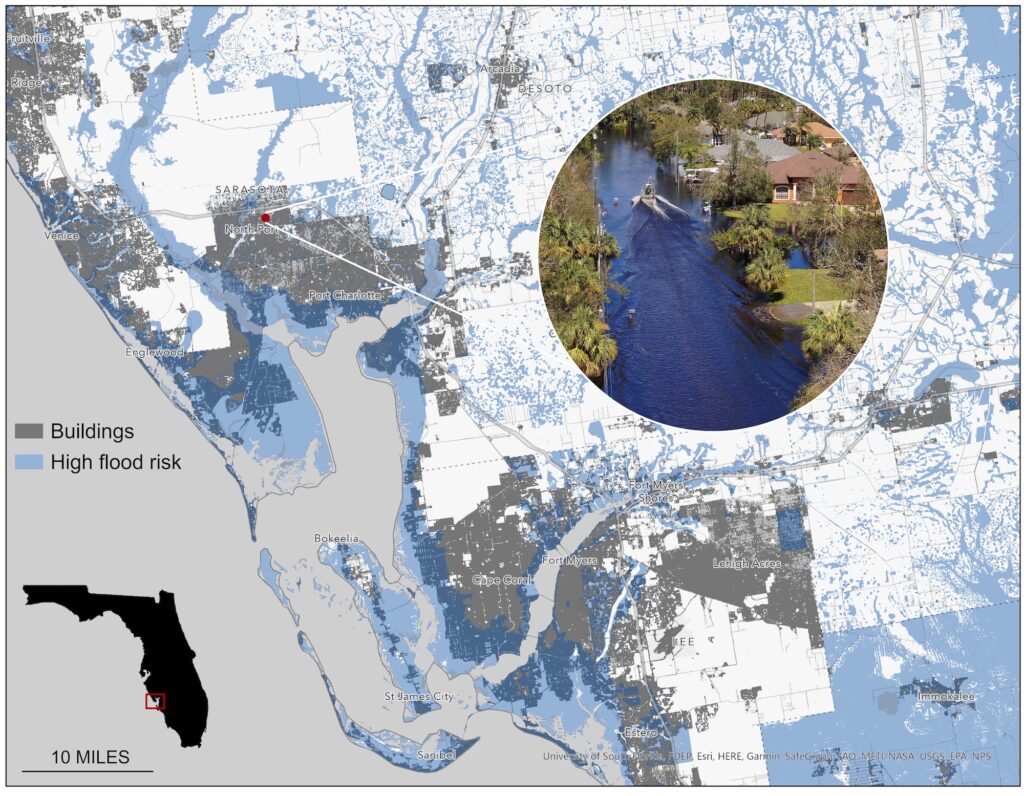

When Hurricane Ian hit the Gulf Coast of Florida on September 28, 2022, the Category 4 storm created a surge of ocean water that rose by one to two stories along some 60 miles of the state’s southwestern coastline, flooding thousands of homes.

Hurricane Ian’s trail of destruction has put a national spotlight on the pitfalls of building in flood-prone areas, with countless media outlets highlighting the fact that more than 80% of homes that were under evacuation orders didn’t have flood insurance.

But the reality is that many homeowners across the United States aren’t actually aware of their property’s risk of flooding, leaving them with little guidance on whether they should purchase a flood insurance policy to cover storm damage.

In fact, only about 4% of homeowners nationwide have flood insurance — a problem that can be largely attributed to the flood maps created by the Federal Emergency Management Agency, according to Georgina Sanchez, a research associate at NC State’s Center for Geospatial Analytics.

FEMA’s flood maps designate areas located in the 100-year floodplain, or where there’s a 1% chance of flooding in any given year. Many Americans rely on these maps to make decisions about where and how to build their homes or businesses.

“Flood maps help determine which areas are at high risk of flooding and, therefore, require flood insurance, structural adaptations, or are eligible for federal buyout,” Sanchez said.

Flooding typically isn’t covered by standard insurance policies, so homeowners with government-backed mortgages are required to purchase flood insurance separately — usually through FEMA’s National Flood Insurance Program — when their property is located in the 100-year floodplain.

Unfortunately, FEMA’s flood maps underestimate the risk of flooding by failing to account for intense rainfall events and sea level rise. These conditions are becoming more common as climate change accelerates, increasing the likelihood and seriousness of flooding.

Additionally, FEMA doesn’t quickly and continuously update its flood maps to consider urban intensification and expansion. The conversion of natural lands to roads and other impervious surfaces results in increased stormwater runoff, which aggravates flooding.

“FEMA’s designation of high-risk flood zones can mislead communities about their actual risk and encourage development that borders the floodplain, resulting in greater damages when flood events exceed design levels,” Sanchez said.

Sanchez added that the flood mapping process is time-consuming, research-intensive and expensive. Consequently, FEMA has only developed flood maps for 61% of the continental U.S., leaving thousands of communities vulnerable to flood damage.

Recently, Sanchez collaborated with Elyssa Collins, a doctoral candidate in the Center for Geospatial Analytics, and other NC State researchers to create computer models capable of predicting where flood damage is likely to happen in the continental U.S.

The researchers “trained” the computer models with reported data of flood damage for the U.S., along with other information, from the National Oceanic and Atmospheric Administration made between December 2006 and May 2020.

Comparing the data with FEMA’s flood maps from 2020, Sanchez and her colleagues found that the majority of the damage reports, at 68.3%, were located outside of the agency’s high-risk flood zones, while 16.2% were in unmapped locations.

They also found a high probability of flood damage – including monetary damage, human injury and/or loss of life – for more than 1.01 million square miles across the U.S. FEMA’s maps of the 100-year floodplain only account for 221,000 square miles.

“Following Ian, and many other major hurricanes, we have observed serious flood damage beyond the boundaries of the 100-year floodplain,” Sanchez said. “This suggests that there are communities across the nation susceptible to damage that our current flood management policies don’t consider.”

Sanchez added that FEMA’s flood maps oversimplify risk by utilizing static, categorical boundaries for the 100-year floodplain. “Properties outside of the floodplain are considered to have ‘minimal risk’, regardless of whether they stand a foot or a mile outside, and are not subject to protective regulations.”

Beginning in 2021, FEMA’s National Flood Insurance Program began incorporating additional flood risk variables — flood frequency, flood type, and property characteristics — into the mapping process as part of a new strategy called Risk Rating 2.0.

According to Sanchez, however, FEMA is only using Risk Rating 2.0 to improve estimates of flood insurance premiums for property owners located inside of designated high-risk flood zones.

“While it is an important step in acknowledging that flood risk varies across geographies, flood risk estimates must account for rapid changes in our landscapes and climate” Sanchez said.

Sanchez and Collins are currently working with other NC State researchers and the U.S. Geological Survey to create simulations depicting how annual flooding probabilities are likely to change over the next century under various global climate scenarios.

The simulations will ultimately provide land-use planners across the country with “computationally efficient predictions of flood risk that can be rapidly updated as conditions change or new data becomes available,” Sanchez said.

“Data-driven methods could complement FEMA’s current flood risk estimates to provide more robust predictions,” she concluded.

- Categories: